Let's make this real. Using the Denver metro area as an example, the median home price is around $599,000. A 10% drop isn't a headline; it's a $59,900 loss in your family's net worth.

Now, here's where the danger truly lies:

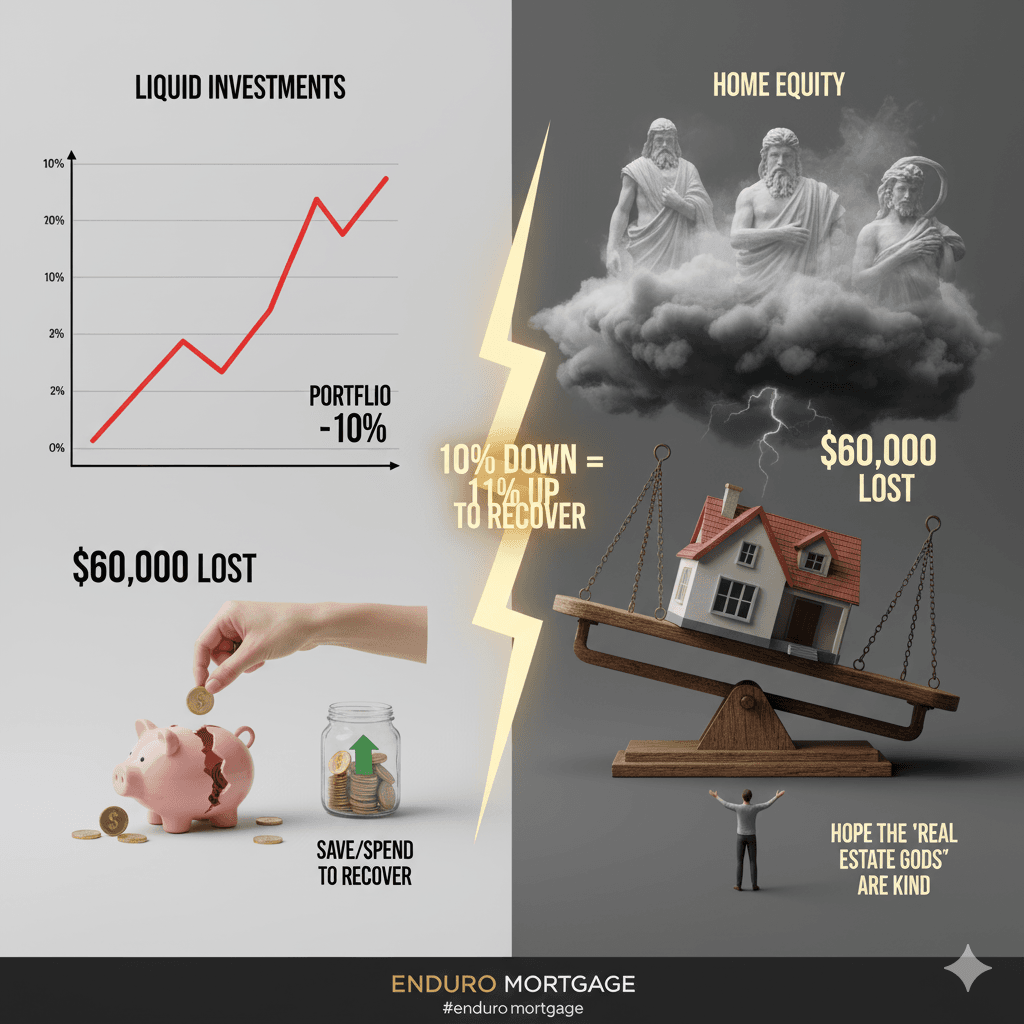

When your investment account drops by $60,000, it's painful, but you have some control over the recovery. You can choose to save more or spend less to help replace what was lost. You have some control to recapture that lost $60,000.

But when your home's equity drops by the same amount, what can you do?

You can't "save" more equity. You can't "spend less" to make your home's value go back up. Your only option is to wait and hope that the "real estate gods" will be kind to you in the future. You have given up all control.

And to make matters worse, the math of recovery isn't symmetrical. If your $600,000 home loses 10% ($60,000), it's now worth $540,000. To get back to even, that $540,000 now has to gain over 11% just to recover your original value.

Would you ever let your investment account lose $60,000 without having a serious conversation with your financial advisor about a defensive strategy? Of course not. So why are we treating our home equity—which for most is a far larger asset—with less urgency?

This is where a reverse mortgage becomes a powerful strategic tool. It allows you to apply the same savvy logic to your home's equity that you do to your other investments.

By establishing a line of credit now, you can "lock in" a portion of your equity based on your home's current dollar value.

This creates a powerful defense. Even if the market value of your home continues to decline—losing another $20,000, $30,000, or more—your available line of credit is secure. You have converted your vulnerable, "on-paper" dollars into a stable, usable asset that is protected from future market declines.

Your home equity isn't a percentage; it's a lifetime of hard-earned dollars. In a volatile market, leaving those dollars unprotected is a risk you don't have to take. It's time to take back control from the "real estate gods." If you have questions, complete the form next to this post and let’s have a mutual Q&A to discover your path to protecting your most valuable asset: your home’s equity.

Representing: Enduro Mortgage, Colorado Mortgage Company Registration

NMLS# 2127434 Regulated by the Division of Real Estate

EQUAL HOUSING OPPORTUNITY https://nmlsconsumeraccess.org

Mortgage Broker

Enduro Mortgage | NMLS: 283159