The Question of the Day: Is a Mortgage Free Home Worth More than Cash in Hand?

The Question of the Day

I’ve been wrestling with a numbers problem all week.

For years, we’ve been the same thing: “A mortgage-free home is the foundation of a secure retirement”. It’s the standard advice. It’s what our parents did.

I was reviewing a family’s situation this week—a couple in their late 50s with a beautiful home in Colorado and a huge mortgage payment—and I realized something that felt like a cross between a gut punch and an epiphany.

This standard advice worked for our parents, but today’s retirement lasts longer and costs more than theirs, which is the bad news. The good news is that there are alternatives our parents didn’t have..

Like many seniors, they took advantage of the low interest rates in 2021-2022 and refinanced. They lowered their monthly payment, but they also triggered a re-amortization of their loan, which means 80 to 85% of their payment is applied to interest.

This doesn’t pay down the loan balance and create more equity, which isn’t the goal of a mortgage-free retirement, is it?

They have $600k in equity, but if their car breaks down or they want to help their daughter with a down payment, they have to raid their savings or break out the credit cards.

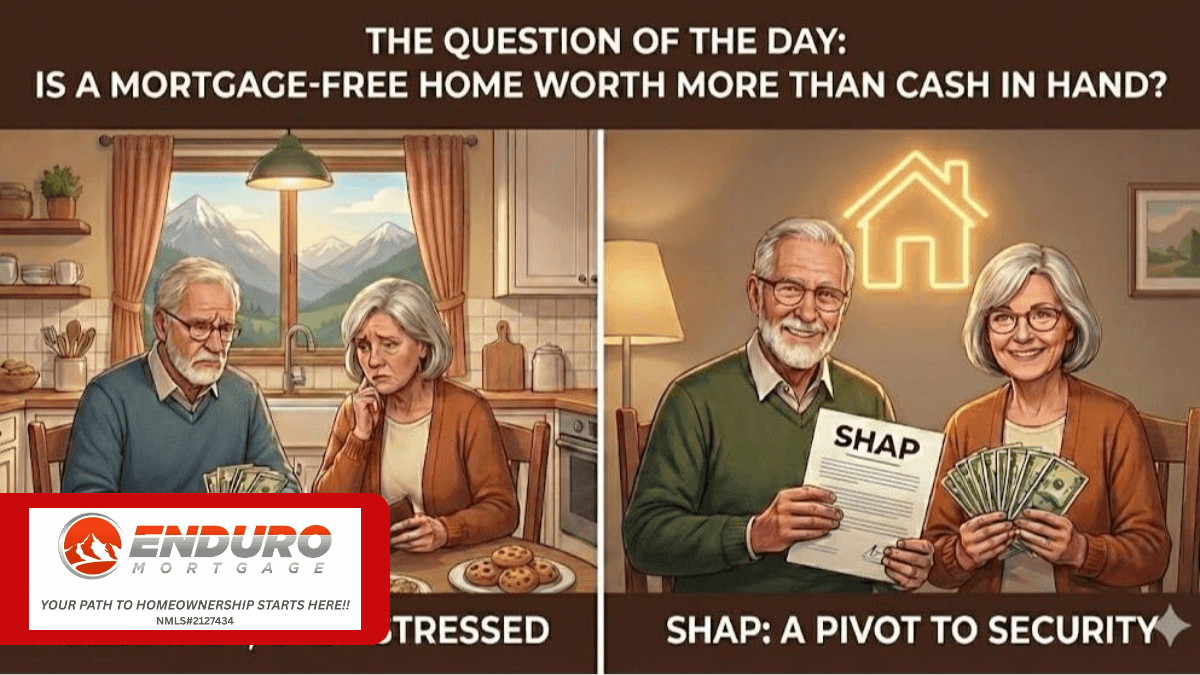

They are "House Rich" but "Cash Stressed."

Here is my Question of the Day: If you could defer making your monthly payments - without selling your home—and instead put that money into your own pocket to be used as you choose- why wouldn't you?

I’ve been exploring the math behind a strategy called SHAP (Senior Homeowners’ Advantage Plan). It’s not your parents’ way of doing things, and it’s definitely not the "loan of last resort" you’ve heard about. It’s a way to pivot your home from a monthly mortgage payment to a more secure retirement.

I’m still mapping out the long-term impact for my clients, but the initial results are eye-opening.

What do you think? Is a mortgage-free home worth more than having the cash in your hand today while you’re still young enough to use it?

Representing: Enduro Mortgage, Colorado Mortgage Company Registration

NMLS# 2127434 Regulated by the Division of Real Estate

EQUAL HOUSING OPPORTUNITY https://nmlsconsumeraccess.org