How do property values affect the ability to do a cashout refinance!

Understanding how property values impact your cash-out refinance options is crucial for homeowners looking to tap into their home's equity. When you consider a cash-out refinance, you borrow against the equity in your home to access cash for various needs—like home renovations, paying off debt, or funding education. The key factor in this process is your property’s value.

First, let’s discuss what property value actually means. Property value is determined by various factors, including the location of your home, its condition, and the overall real estate market in your area. When property values rise, homeowners gain more equity. Conversely, if values drop, that equity diminishes. This relationship is vital when considering a cash-out refinance because lenders assess your home’s current market value to determine how much equity you can access.

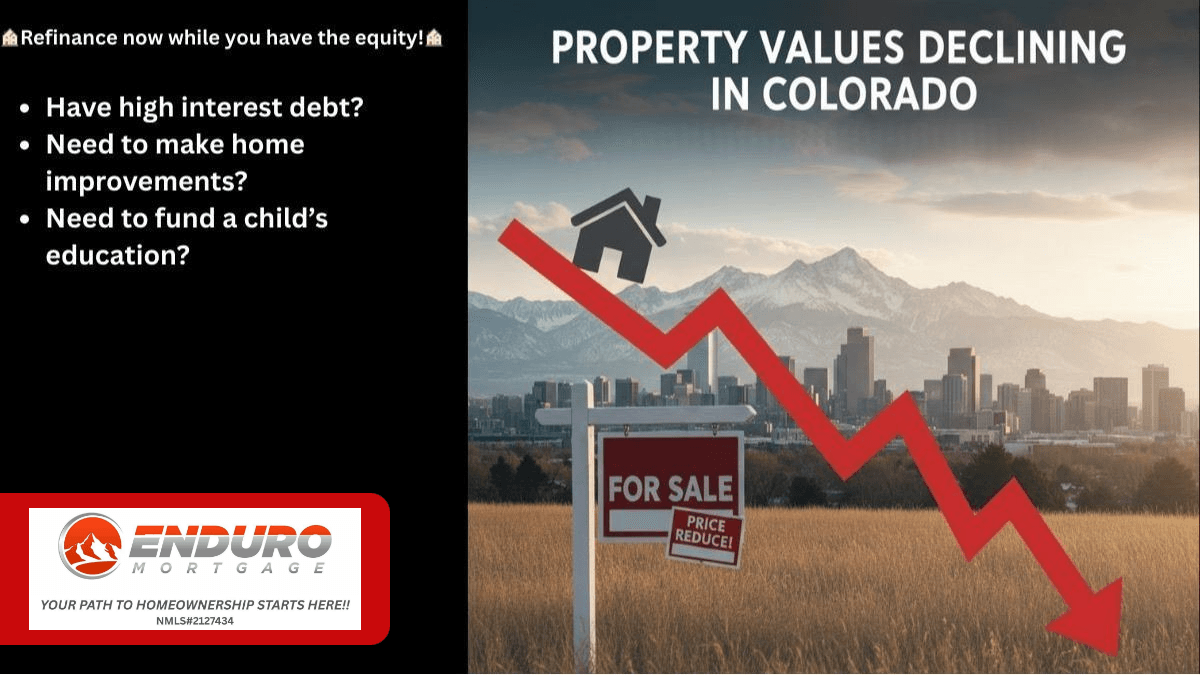

When you initiate a cash-out refinance, the lender will conduct a home appraisal. This appraisal gives an estimated value of your home based on comparable properties, location, and current market trends. If your home has appreciated significantly since you bought it, you might be able to access a substantial amount of cash. However, if property values in your area have declined, your options will be more limited.

So how does this work in practice? Let’s say you purchased your home for $250,000 and its current market value is now $350,000. If you still owe $200,000 on your mortgage, you have $150,000 in equity. Most lenders allow you to cash out a percentage of that equity, often around 80%. This means you could potentially access up to $120,000 in cash through a cash-out refinance. This cash can be incredibly useful for projects, debt consolidation, or unexpected expenses.

On the flip side, if your home’s value has decreased to $225,000 and you owe $200,000, your equity is only $25,000. In this scenario, you would not have enough equity to qualify for a cash-out refinance, as the available equity is not sufficient to meet lender requirements.

Understanding your local real estate market is essential. Keep an eye on trends in your neighborhood. Are properties selling quickly? Are new developments attracting buyers? If your area is seeing growth, your home’s value may increase, enhancing your cash-out refinance options. Conversely, if the market is slowing down, it could be more challenging to qualify for a cash-out refinance.

Another consideration is how you plan to use the cash from the refinance. Being strategic about your cash-out purpose can significantly impact your financial future. For instance, using the funds for home improvements can increase your property value even further, positioning you better for future refinancing opportunities. If you're consolidating high-interest debt, ensure that the savings from lower interest rates will provide long-term benefits.

Before deciding on a cash-out refinance, it’s crucial to have a clear understanding of your financial goals. What do you want to achieve with the cash? Create a plan that outlines your objectives and how the cash will help you reach them. This structured approach can guide your discussions with lenders and clarify your needs.

If you’re considering a cash-out refinance and want to explore your specific options based on your property value and financial situation, I encourage you to reach out. Together, we can discuss how to best meet your financial goals while ensuring that your options align with your home’s current value. Let’s find the right path for you.

Representing: Enduro Mortgage, Colorado Mortgage Company Registration

NMLS# 2127434 Regulated by the Division of Real Estate

EQUAL HOUSING OPPORTUNITY https://nmlsconsumeraccess.org