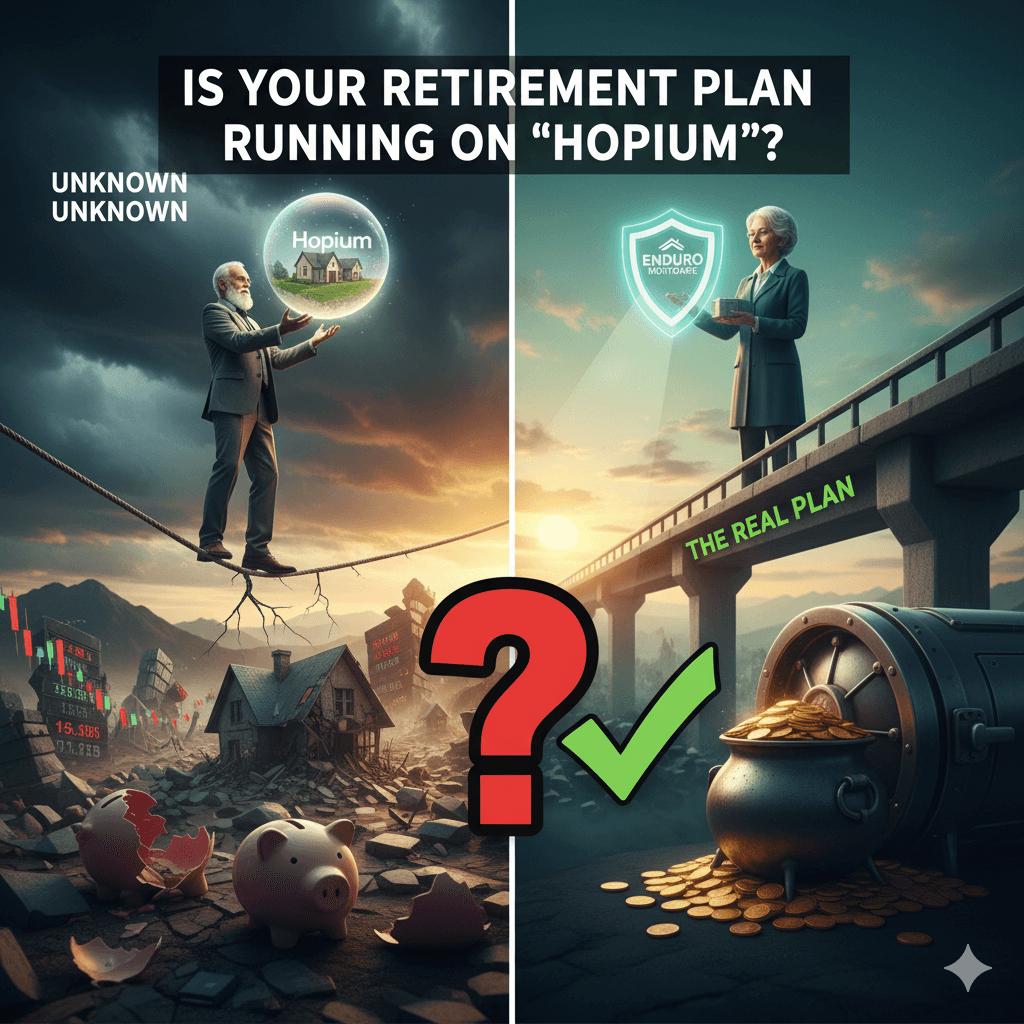

The biggest risk to any retirement plan isn't a predictable dip in the market; it's the completely unpredictable event that shatters all our assumptions.

A retirement plan based on "hopium" is incredibly vulnerable. It assumes that:

Your investments will be accessible when you need them.

Your home's value will be high when you might need to sell it or access the equity.

Your income sources will remain stable and predictable.

A true "black swan" event can simultaneously destroy all three of these assumptions. In a crisis, the stock market can plummet, the housing market can freeze, and the entire economy can lock up. At that moment, a plan based on "hope" is worthless.

So, how do you plan for something impossible to predict?

You don't plan for the specific event; you build a tool that is designed to work when everything else fails. This is where a reverse mortgage line of credit becomes the ultimate "unknown unknown" insurance policy.

Think about its unique features:

It's a contractual guarantee. Unlike your 401(k) or home's market value, your available line of credit cannot be frozen, reduced, or taken away, no matter what happens in the economy. It is a contractual obligation.

It's a non-market-correlated asset. It is completely insulated from stock market crashes and real estate downturns. When all other assets are falling, your line of credit is stable.

It's a source of tax-free cash. In a crisis, the last thing you need is a massive tax bill from a 401(k) withdrawal.

By establishing this line of credit before a crisis, you are creating a financial bunker. It’s a source of funds you can access to ride out the storm, allowing you to leave your panicked neighbors to sell their assets at rock-bottom prices while you wait for the markets to recover.

Hope is not a strategy. A truly resilient retirement plan acknowledges the reality of the "unknown unknowns" and builds a powerful defense against them. A reverse mortgage line of credit is one of the most effective tools to turn a plan based on "hopium" into one based on rock-solid security.

To learn more, complete the sign-in form and we'll be in touch

#Hopium #RetirementPlanning #RiskManagement #BlackSwanEvent #ReverseMortgage #FinancialSecurity #ArizonaSeniors #BePrepared

Representing: Enduro Mortgage, Colorado Mortgage Company Registration

NMLS# 2127434 Regulated by the Division of Real Estate

EQUAL HOUSING OPPORTUNITY https://nmlsconsumeraccess.org

Mortgage Broker

Enduro Mortgage | NMLS: 283159