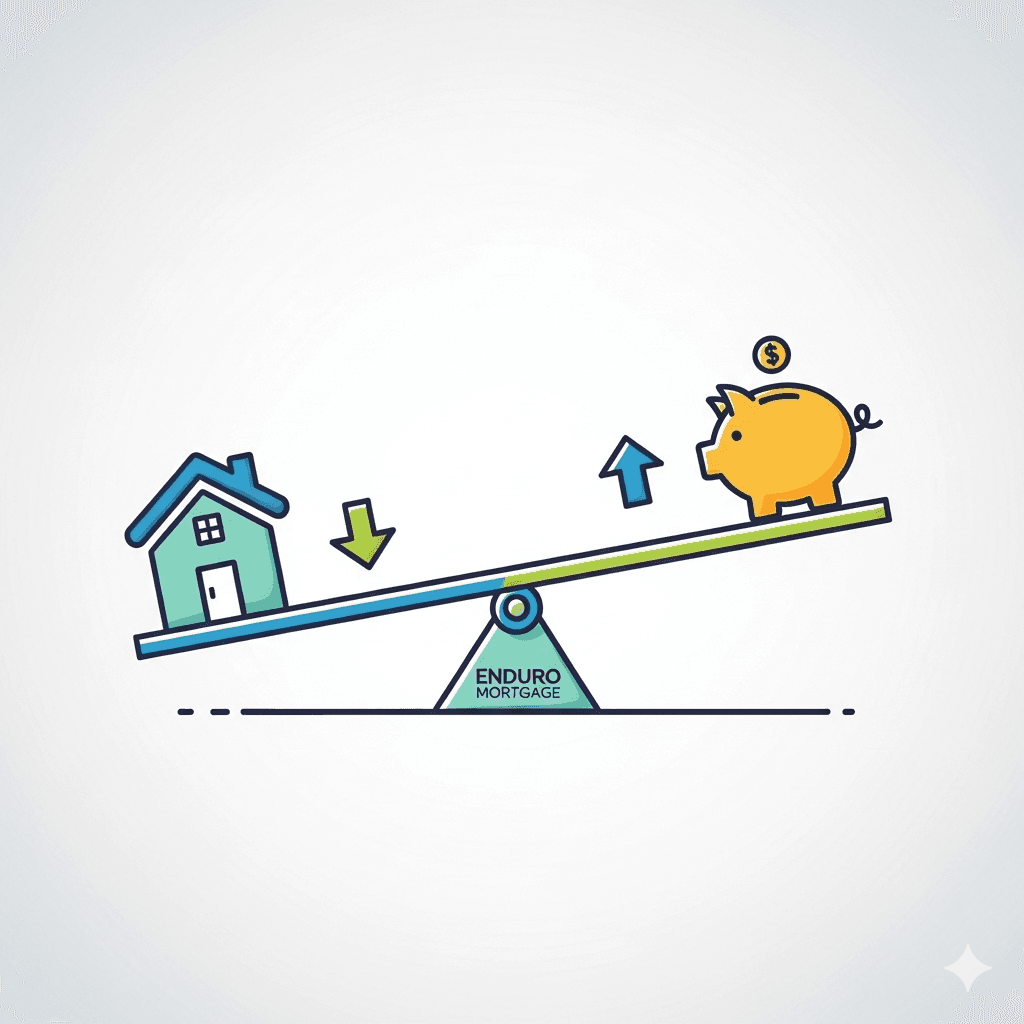

This specific economic moment—where interest rates are falling while home values are still relatively high but softening—creates a unique and timely advantage for those considering a reverse mortgage. Here's why:

A reverse mortgage is based on the current appraised value of your home. By acting now, you can lock in a loan amount based on today's still-high valuation, protecting yourself from potential future declines in the market. It’s a way to capture the equity you've built before it potentially erodes further.

It's a simple formula: lower interest rates often mean that you're eligible to access a larger portion of your home's value. This benefit can help offset the recent dip in home prices, meaning you might be able to access the same amount of cash—or even more—than you could have a year ago when values were higher but so were rates.

This new environment makes a reverse mortgage an even more competitive choice. With rates on credit cards and traditional home equity loans (HELOCs) still high, using a reverse mortgage to pay off debt or fund a project becomes a smarter financial move.

We don't know what the future holds for home values or interest rates. But today's unique market is creating a favorable environment for homeowners who want to secure their financial future. If you've been waiting for the right moment, this could be it.

It all starts with a simple, no-pressure conversation to see what today's new reality could mean for you and your family.

#HomeValues #InterestRates #RetirementPlanning #WindowOfOpportunity #ReverseMortgage #SecureRetirement #ArizonaSeniors #RealEstateMarket

Representing: Enduro Mortgage, Colorado Mortgage Company Registration

NMLS# 2127434 Regulated by the Division of Real Estate

EQUAL HOUSING OPPORTUNITY https://nmlsconsumeraccess.org

Mortgage Broker

Enduro Mortgage | NMLS: 283159