As a quick refresher, the debt snowball method is a focused strategy for paying off debt. You list debts from smallest to largest, attack the smallest one first with extra payments, and once it’s gone, you "roll" that payment over to the next one. It’s effective and motivating, but it takes time.

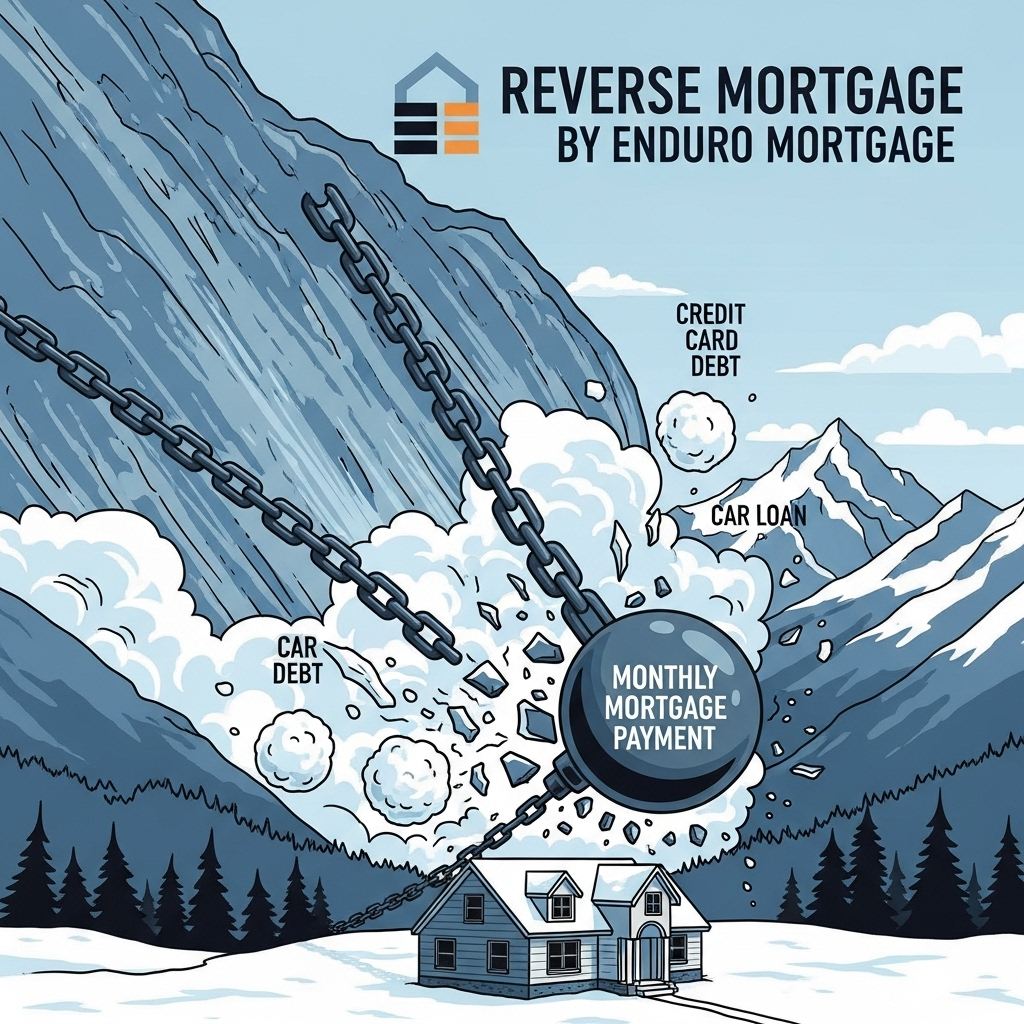

As we've discussed, a reverse mortgage from Enduro Mortgage can turn that snowball into an avalanche. By accessing your home equity, you can get a lump sum to wipe out high-interest debts like credit cards and car loans.

The most powerful part? The funds you use have no required monthly mortgage payment. So, you eliminate those monthly debt payments without adding a new one in their place, drastically improving your cash flow to tackle other goals. This alone is a game-changer.

But for many, this is just the beginning of what’s possible.

Now, let's take this to the next level. What if the avalanche was powerful enough to wipe out everything, including your existing mortgage?

This is the ultimate retirement strategy for many Coloradans. A reverse mortgage can be used to pay off your existing, traditional mortgage balance. When this happens, your financial landscape is transformed overnight.

Let's imagine a new scenario for Pat from Aurora:

Pat has a great life in Colorado but is still managing several monthly payments:

Pat’s total monthly debt payments are $1,600. Now, watch the ultimate avalanche in action.

Pat works with Enduro Mortgage and uses a reverse mortgage to pay off all three debts. The proceeds are used to eliminate the credit card, the car loan, AND the entire remaining $80,000 mortgage balance.

The result is staggering:

This isn’t just a snowball; it’s a seismic shift in financial freedom. The loan is simply repaid down the road when Pat sells the home or no longer lives there.

This is where the dream of a Colorado retirement becomes a vivid reality. Ask yourself:

This strategy moves you from defense to offense. You’re no longer just managing—you’re thriving.

You've spent years building equity in your Colorado home. The possibility of using that equity to eliminate your single largest monthly expense is a conversation worth having. It's the key to unlocking the secure, joyful retirement you've worked so hard to achieve.

If you're a Colorado homeowner age 62 or older, with or without a current mortgage, let's explore what's possible.

Ready to see if the ultimate avalanche is an option for you? Let's have a no-obligation conversation about your unique situation. We are here to provide clarity and help you determine if an Enduro Mortgage reverse mortgage is the right tool to achieve your financial goals.

To make sure everything goes smoothly, it's helpful to think of this as a partnership. You get to eliminate your monthly mortgage payment, and in return, you continue to care for your home just as you always have. This includes staying on top of property taxes and homeowners insurance, and keeping the property in good shape. The home also needs to remain your primary residence. Fulfilling these homeowner duties is what keeps the loan agreement active and prevents it from becoming due for repayment.

Representing: Enduro Mortgage, Colorado Mortgage Company Registration

NMLS# 2127434 Regulated by the Division of Real Estate

EQUAL HOUSING OPPORTUNITY https://nmlsconsumeraccess.org

Mortgage Broker

Enduro Mortgage | NMLS: 283159