A retirement plan based on historical averages and predictable outcomes is vulnerable to a black swan event. In a true crisis:

The stock market can plummet, making a 401(k) a dangerous source of cash. (think 9/11)

The housing market can freeze, making home equity illiquid. (think 2008)

Even the availability of traditional bank home equity loans can dry up overnight. (think 2008,2020)

A black swan event attacks a client's assets precisely when they need them most.

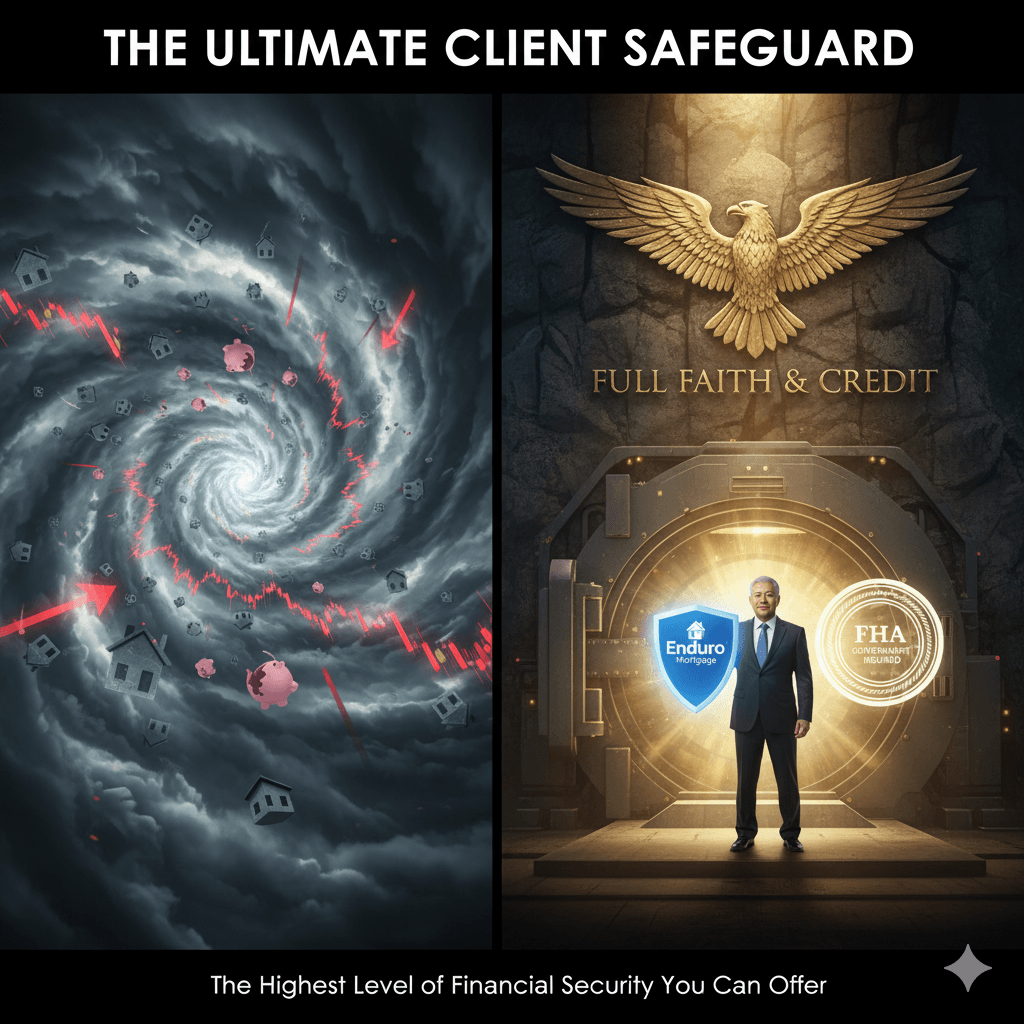

This is where my perspective shifted. It dawned on me that the tool I work with every day—the HECM line of credit—isn't just a loan. It's the ultimate form of "black swan insurance" for a homeowner's portfolio. Its power lies in its unique characteristics:

It's Constitutionally Guaranteed: Unlike a 401(k) or a home's value, the available line of credit cannot be frozen, reduced, or taken away because of a market crash. The funds are guaranteed by the “full faith and credit” clause of the Constitution.

It's a Non-Market-Correlated Asset: It is completely insulated from stock market crashes and real estate downturns. When all other assets are falling, the line of credit is stable and accessible.

It’s access to “tax-free” money that doesn’t impact the budget at a time when money is at a premium.

By establishing this line of credit before a crisis, we are creating a financial bunker for our clients. It’s a source of tax-free funds they can use to ride out the storm, leaving their other assets untouched to recover.

When a "black swan" event creates a liquidity crisis for your client, their access to traditional capital can evaporate overnight. Their portfolio is down, and HELOCs may be frozen.

This is where the HECM line of credit demonstrates its unique value as a risk management tool.

It is a government-insured source of liquidity that is completely insulated from market chaos. The FHA's commitment to this program is backed by the full faith and credit of the United States government, the same guarantee that backs Treasury securities.

This means the promise to protect your client's plan is not just a corporate policy. It's the highest level of financial security you can offer.

Representing: Enduro Mortgage, Colorado Mortgage Company Registration

NMLS# 2127434 Regulated by the Division of Real Estate

EQUAL HOUSING OPPORTUNITY https://nmlsconsumeraccess.org

Mortgage Broker

Enduro Mortgage | NMLS: 283159